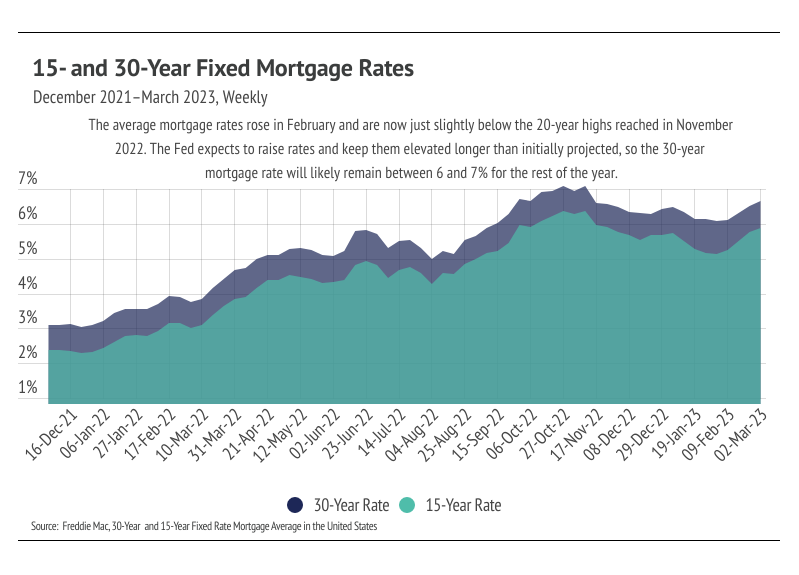

As we step into the second quarter of 2023, the San Diego real estate market has been on a wild ride. The market experienced a sudden spike in buyer interest with the New Year, thanks to a dip in mortgage interest rates. However, things quickly changed, as rates rose again, leaving many in the industry to wonder what’s next.

But as they say, every challenge presents an opportunity. So, how can you leverage this market volatility for your benefit? In this blog post, we’ll delve into the happenings of the past quarter and reveal some proven strategies that could give you an edge in the ever-changing San Diego real estate landscape. Welcome to our latest Real Estate Market Report!

Mixed Signals:

-

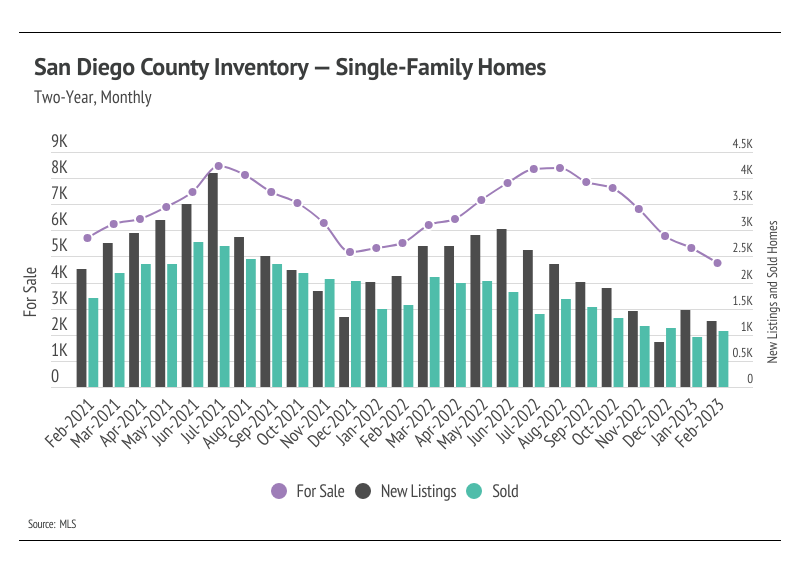

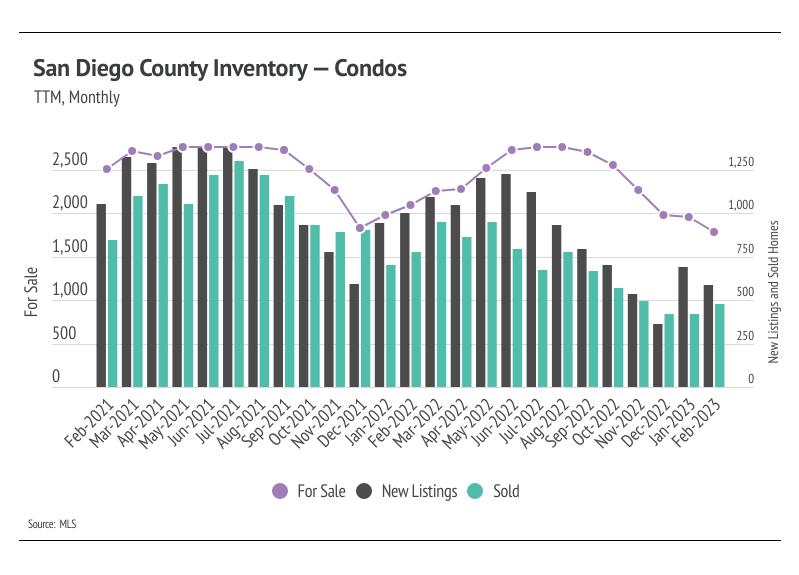

Active listings in San Diego County dropped further in February as fewer listings came to market, causing inventory to reach an all-time low for the second month in a row.

-

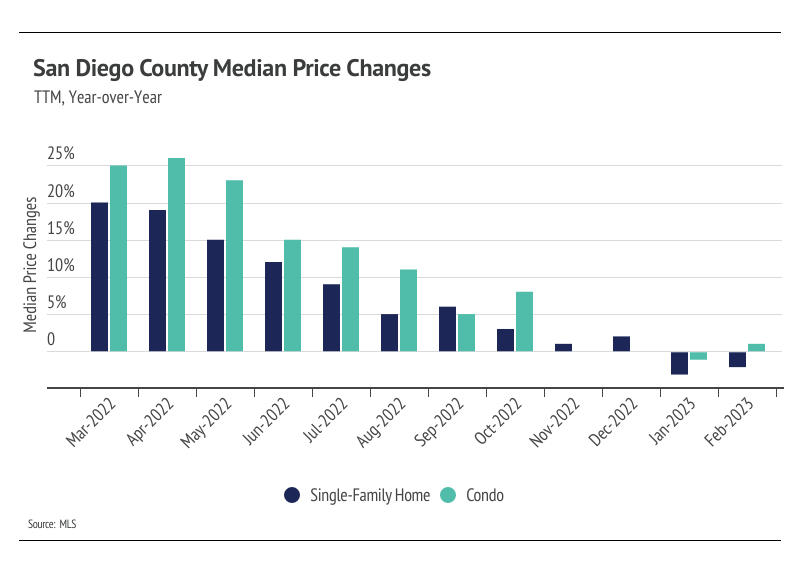

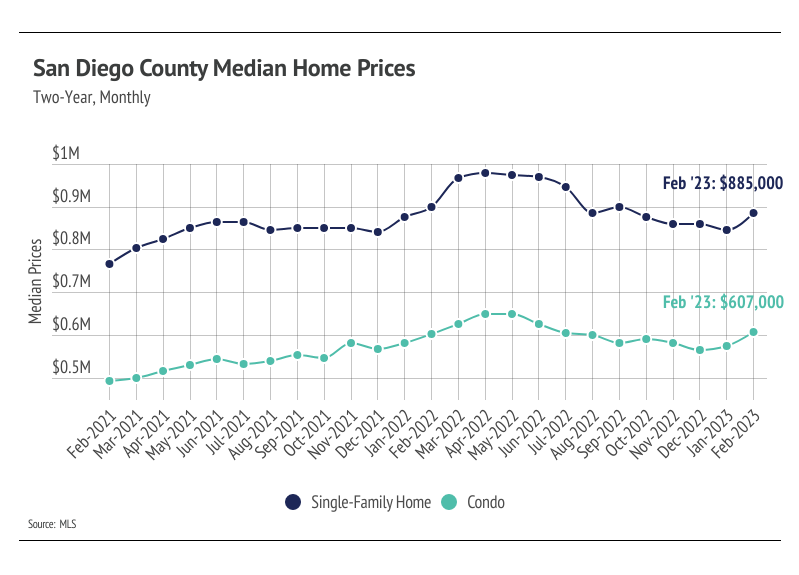

Home prices rose meaningfully month over month, signaling that low inventory and seasonality are still affecting pricing despite higher mortgage rates.

-

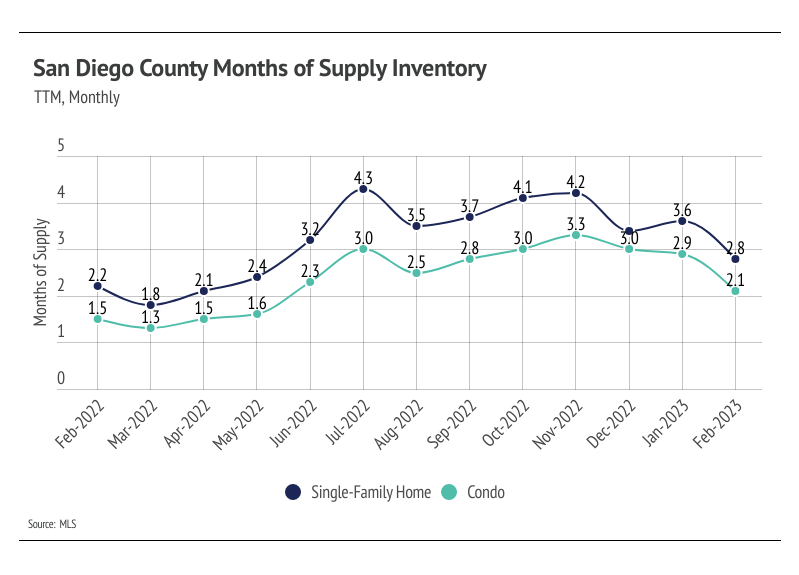

Months of Supply Inventory declined as sales increased and homes sold faster month over month, indicating the market has moved back to a sellers’ market.

Typical and atypical seasonal trends

During this time of the year, we typically observe a steady rise in both inventory and sales until mid-summer. This is because of the relatively high number of new property listings that usually come to market in the first half of the year.

Although sales increased, the number of new listings has decreased from January to February, indicating that inventory might struggle to grow this year. Even though sales are expected to be more subdued this year, there is a possibility that demand could start surpassing supply, particularly if the sales continue to rise without being met by more new listings.

Despite higher mortgage rates, San Diego is experiencing greater demand than the rest of the state due to several key reasons. Firstly, people aspire to live in the beautiful San Diego County. Secondly, homes are still relatively affordable, despite sustaining much of the price growth from mid-2020 to mid-2022, which translates to more market participants.

The San Diego real estate market has shown to be one of the most stable and resilient in the United States. Single-family home prices have risen by 15.7% over the past two years, after a decline of only 9.7% from the peak in April 2022. On the other hand, condo prices have only fallen by 6.6% from the peak in May 2022, rising by 23.4% over the past two years.

Homebuyers in San Diego and Southern California can still find a home within their budget, allowing them to obtain a conventional loan to make the purchase. Moreover, they can expect to refinance in the future, which will lower their monthly expenses.

Over the next three months, it will be interesting to observe how buyers and sellers react to the current market conditions. However, initial signs point towards increased competition in San Diego as we enter the spring season.

Inventory hits record lows

In February 2023, both single-family home and condo inventory hit an all-time low. The increase in interest rates has resulted in a reduction of incentives for potential sellers to enter the market, as they will also need to purchase a new home.

Many homeowners either recently bought or refinanced their homes, taking advantage of the historically low interest rates. This means they are less likely to sell, resulting in fewer listings available in the market. Additionally, the rise in interest rates has caused many potential buyers to be priced out of the market.

However, since interest rates have been higher for some time, buyers are now more comfortable re-entering desirable markets like San Diego.

At present, buyers are not experiencing the same level of competition seen in the hypercompetitive market of 2021. Nevertheless, we can expect to see more competition among buyers as we move into the spring season.

According to data, new listings have decreased by 40.8% year over year, while sales have declined by 34.5%. While we still expect some inventory growth in the first half of 2023, inventory will likely remain low.

Months of Supply Inventory dropped, indicating a sellers’ market

Months of Supply Inventory (MSI) is an important metric that measures the relationship between supply and demand in the housing market. It determines how many months it would take for all the current homes listed on the market to sell at the current rate of sales.

In California, the long-term average MSI is approximately three months, which indicates a balanced market where there is a relatively equal number of buyers and sellers. However, in February, the MSI for both single-family homes and condos dropped, indicating that the market favors sellers.

A lower MSI than three suggests that there are more buyers than sellers on the market, which creates a sellers’ market. On the other hand, a higher MSI indicates that there are more sellers than buyers, which creates a buyers’ market. The drop in MSI occurred due to homes selling more quickly and fewer new listings coming to market.

When it comes to making a decision about buying or selling a home in San Diego, it’s important to have access to accurate and reliable information. So don’t hesitate to contact us for a free consultation at 858.630.8997.