The San Diego real estate market has been on a wild ride, marked by fluctuating mortgage rates and shifting affordability. This might be a difficult time if you’re financing a home, but also the opportunity you’ve been waiting for if you’re a cash buyer.

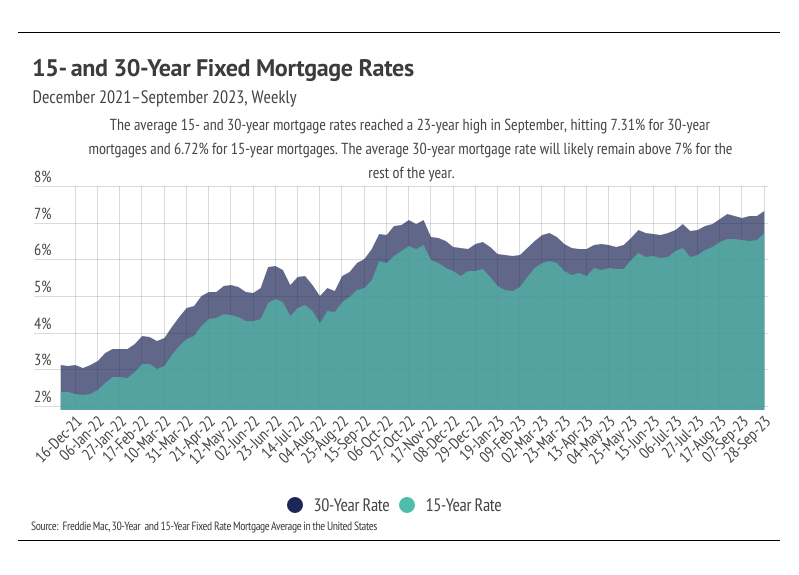

+8% Mortgage Rate Era

The national median home price is just 1.6% below its all-time high from June 2022, showcasing remarkable stability despite soaring interest rates. However, the 30-year mortgage rate reached a staggering 8.04% in October, posing challenges to affordability and homebuilding. Home sales have dipped below levels seen during the initial pandemic slowdown in May 2020.

The Great Affordability Drop

In October, the 30-year mortgage rate reached a 23-year high, closing the month at 8.04%. These soaring rates have had a pronounced impact on affordability. To put it into perspective, in 2020 and 2021, the 30-year mortgage rates hit historic lows, averaging 3.11% and 2.96%, respectively. These low rates attracted a surge of buyers, intensifying demand and driving prices upwards at an unprecedented rate.

The current market presents a unique dynamic of limited supply and demand, partly driven by seller sentiment. Approximately 75% of U.S. homeowners hold mortgage rates below 4%, which has deterred many from listing their homes. However, despite the challenges, the balance between supply and demand has tipped in favor of sellers, helping to maintain high prices.

What’s Happening around San Diego

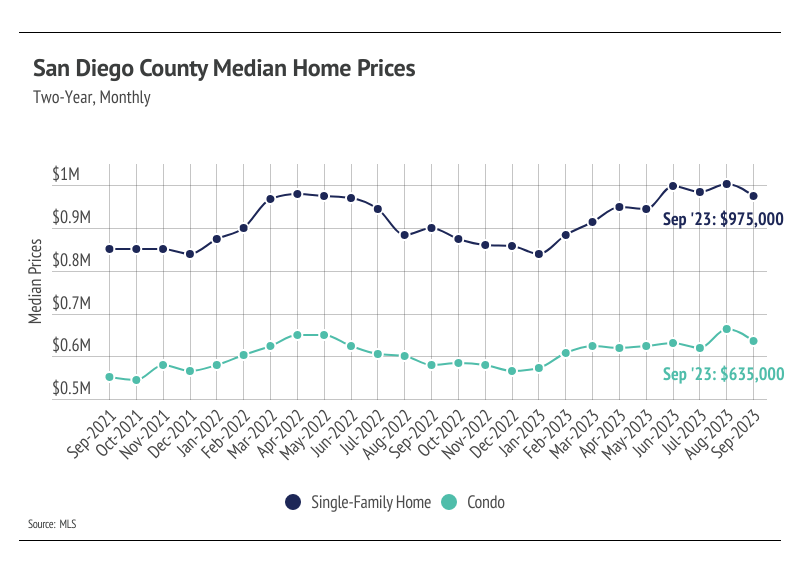

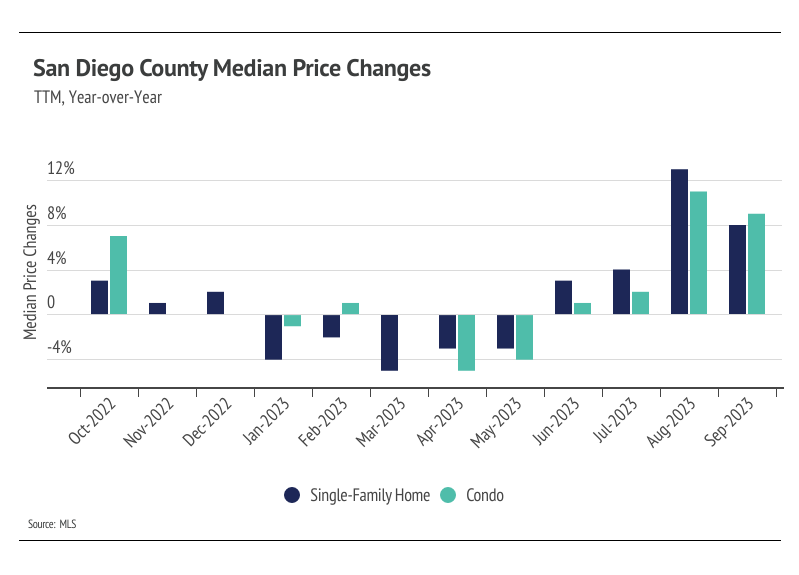

Median prices for single-family homes and condos in San Diego have slightly declined from their all-time highs in August. Active listings in San Diego County have decreased, contributing to a record low in single-family home inventory. Although there’s been a rise in Months of Supply Inventory, the market still favors sellers.

Prices Fell but at Record Highs

San Diego County’s housing prices remain relatively affordable, especially in the context of California. While median prices have dipped from their August highs, the ongoing shortage of inventory and new listings provides support as we head into the slower fall and winter seasons. This trend is expected to persist for the remainder of the year.

Typically, demand softens in the fall and hits its lowest point in January. However, with mortgage rates at a 23-year high, quality listings are likely to face intense competition. Despite this, potential buyers are less inclined to pay a premium for fixer-uppers compared to 2020 and 2021.

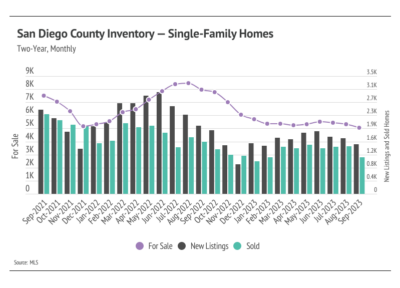

Single-Family Home Inventory Hits All-Time Low

Over the past 12 months, both single-family home and condo inventory in San Diego have trended downwards, deviating from the seasonal norm. Single-family home inventory reached an all-time low in September, a clear departure from typical inventory patterns. While demand is easing due to higher interest rates and normal seasonality, the shortage of inventory means that any new listings are a positive sign for the market.

Comparing new listings from January through September 2023 to the same period in 2022, we see a 33% decrease, which directly impacts both inventory and sales. As demand weakens, buyers gain more negotiating power, and they are now paying slightly less than the asking price on average. Despite these changes, inventory is expected to remain historically low for the rest of the year and likely into 2024, providing continued price support.

The bottom line is that the San Diego real estate market is navigating turbulent waters due to soaring mortgage rates and evolving buyer behaviors. The current imbalance between supply and demand is likely to persist, impacting prices and negotiations.

If the lack of inventory has you frustrated, contact us about our Off Market Buyers Program.